Infosys has finally put to rest the rumors regarding the appointment of Chief Executive Officer (CEO) by naming Mr. Vishal Sikka as the new CEO and also the managing director. Mr. S.D. Shibulal is relinquishing the title and will hand over the reins to him on August 1, 2014. Apart from this, executive chairman N R Narayan Murthy and his son Rohan Murthy have also decided to exit the company by October 2014. Since the return of the company’s founder N R Narayan Murthy, there has been a massive exodus of top-level management with as many as 12 senior leaders quitting the company in 12 months. For a company already battling a high attrition rate of 18% (as per the data of April 2014), this exodus was a big blow as the fears mounted that the company was falling apart. The appointment of Vishal Sikka, earlier the member of the executive board of SAP AG, is sure to calm some fretted nerves.

But does this mean that a quick turnaround will happen any time soon? Should the investors get a little cautious? What does it mean for the stock price? Has the Dalal Street given its thumbs-up to the move?

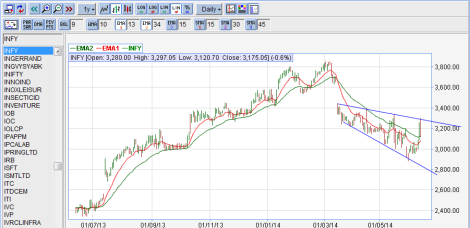

Let us see what the market is telling and not listen to rumors nor make any assumptions which may cost us dearly in the future. Below is a daily OHLC chart which accurately depicts what the market is factoring in and also answers our questions easily because in this market, price is all that matters!

Image: www.icharts.in

The stock price of Infosys (NSE: INFY) after having registered a 52-week high of Rs 3849.95 has been facing consistent selling pressure. The chart structure clearly represents a lower-top lower-bottom pattern with no signs of revival as of yet.

The stock price has been trading in the above marked trading range from 13th March 2014 till this date. Even after the announcement of Vishal Sikka as the new CMD, the stock could not breach the price band on the upside (not so positive after all!). In fact, after having registered an intraday high of Rs 3297, the stock started sliding downwards and gave up all the gains in no time and soon you could see it trading at more than 1% down. Maybe it was the euphoria that led to the gains, but the smart money was quick to realize that a revival may be some more time away; the street might want to wait before it gives its final thumbs-up.

Investors also must get cautious as the price pattern suggests a deep down move to the levels of Rs 2800, which might act as a strong near-term support. Fresh buying should be done only after the resistance level of Rs 3300 has been taken out decisively.

The markets are far more prudent than we think and clearly reflect what it sees ahead in the prices. Hence, we must never forget that “trend is indeed our friend.”

P.S.: – Do share this message if you have gained something insightful and help others too. Also, feel free to post any questions, comments or feedback that you may have.

Image:

Image:

Reblogged this on Namta Gupta and commented:

Succession battle in Infosys, top managers leave while Narayan Murthy and his son exit. How will the market react? Read here!

LikeLike